What Helped Me Stop Hating Budgeting and Start Saving

I used to think budgeting meant spreadsheets, guilt, and giving up iced lattes. It always felt like something other people were good at — the organized, finance-savvy types. Meanwhile, I was just trying to not cry every time I opened my bank app.

But over time (and after some truly humbling months of overdraft fees and random impulse buys), I realized budgeting isn’t about being perfect — it’s about having a plan that works for you. And once I started finding little hacks that made it easier — even fun, in a weird way — saving money didn’t feel so impossible anymore.

So this post isn’t about becoming a budgeting pro overnight. It’s about small, real-life shifts that helped me feel less stressed about money. These tips are especially helpful if you’re new to this whole “budgeting finances for beginners” thing. And I promise — no complicated formulas required.

1. Create a “No-Guilt” Fun Fund

Here’s something I wish I’d learned way earlier: budgeting doesn’t mean you stop spending on things you love. It just means you decide in advance how much to spend — and give yourself permission to enjoy it.

I started putting aside $40 a month into a “fun” category. That’s not a lot, but it meant I could say yes to coffee dates or a cheap concert ticket without spiraling into guilt later. Knowing I had money set aside for fun made it way easier to say no to impulse purchases — because I wasn’t feeling deprived all the time.

Why it works: You’re not cutting joy out of your budget — you’re building it in intentionally. That shift alone made budgeting feel way less restrictive.

2. Use the “Daily Spending Cap” Trick

This one helped me the most when I was just starting to track my expenses. I picked a reasonable daily cap — for me, it was $20 — and tried not to go over that, on average. Some days I’d spend $5, some $25, but having a simple number in mind gave me an easy anchor.

It also made me think more creatively. Like instead of grabbing takeout twice a day, I’d stretch that $20 with groceries and cook something simple. I didn’t always hit the mark, but just having that little number in my head helped a lot.

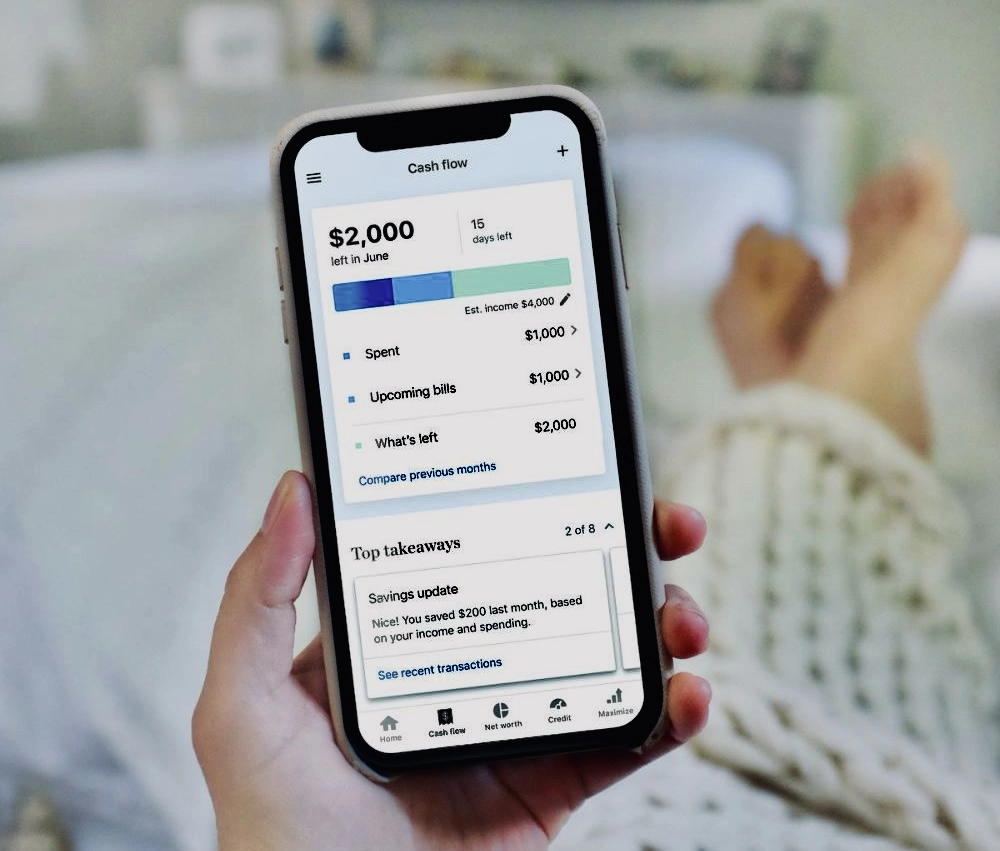

Pro tip: Use a notes app or free budgeting app to jot down what you spend each day. It takes 2 minutes and makes you more aware without obsessing over every penny.

3. Set “Autopilot” Rules For Your Money

One of the easiest budgeting tips I ever learned: automation is your best friend.

As soon as I get paid, I have automatic transfers set up: a chunk goes to savings, another to my credit card, and a tiny bit to that fun fund I mentioned earlier. It’s not about how much — even $10 makes a difference. What matters is doing it without thinking about it every month.

It’s like putting your money on autopilot so you don’t have to constantly decide what to do with it. And when you’re tired or stressed, having those systems in place means your financial goals still move forward — even if you’re not actively budgeting.

One month, I forgot to set up my usual transfers after switching banks — and I ended up spending nearly my entire paycheck without realizing it. It was such a wake-up call. That’s when I realized automation wasn’t just helpful — it was essential. It protected me from my own forgetfulness.

4. Make Budgeting Visual (and Kind of Fun)

I know this sounds silly, but adding a visual element to my budget changed everything.

I made a super basic habit tracker in my journal where I could color in boxes for each “no-spend” day or savings goal hit. It was low-tech but weirdly satisfying. You could also use a printable savings tracker, a jar with stickers — whatever makes it feel real and visible.

This might sound childish, but honestly? It works. You get that little dopamine hit without spending money, which is a win in itself.

Color-coding categories in a budget app (like green for “needs,” yellow for “wants,” pink for “oops”) helped me see where my money was going at a glance. And it made reviewing my budget a little less boring.

5. Create “Mini Budgets” for Short-Term Goals

Long-term financial goals felt too abstract for me in the beginning. But when I broke things down into small, specific goals — like “save $100 for holiday gifts” or “set aside $50 for a weekend trip” — I actually stuck to them.

I’d open a labeled savings sub-account (many online banks let you do this for free) and stash tiny amounts in there. Even just $5 here and there added up.

One time, I sold a few things on Facebook Marketplace and put the cash straight into a “treat myself” fund. A few weeks later, I used it for a spa day without touching my main budget — and it felt amazing.

You’re connecting budgeting to something tangible and exciting — not just vague “adult responsibilities.”

6. Use the “One-Week Delay” Rule

This one helped me with impulse spending so much. Every time I wanted to buy something that wasn’t essential, I’d put it on a “want” list — and wait one week.

Most of the time, I’d totally forget about the item. But occasionally, I’d come back and still want it. And then I could buy it guilt-free, because I knew it wasn’t just a random mood.

Make a note in your phone called “Stuff I Want” and add links or items there instead of hitting “buy now.” You’ll be shocked at how much money you don’t spend.

7. Keep a Low-Key Budget Check-In Once a Week

Every Sunday, I do a five-minute “money check-in.” Nothing fancy — just looking at my bank account, checking my categories, and seeing if I’m on track.

I light a candle, make tea, and make it a little ritual so it doesn’t feel like a chore. It’s honestly become a way to feel in control, not stressed out. Even when the numbers aren’t great, I’d rather know than be surprised later.

Do this with a partner or friend — even if you’re not sharing money. Having accountability and support makes budgeting way less isolating.

What Actually Helped Me Stick With It

I’ve tried a bunch of budgeting ideas over the years — some stuck, some didn’t. But the ones that made a real difference had one thing in common: they felt doable and kind. No shame, no perfectionism, just small actions that worked with my life.

Honestly, I still mess up. I still buy random things at Target. But now I have systems that help me recover faster and keep moving forward. And that’s what makes budgeting feel easy — not that I always get it right, but that I finally have tools that work for me.

If you’re starting from scratch, try just one hack this week. Maybe the daily cap, or the “want list,” or just looking at your spending without judgment. You don’t need to change everything — just begin where you are.